10 dollars an hour 40 hours a week after taxes

To calculate how much you make biweekly before taxes you would multiply 32 by 40. If you make 10 an hour how much is that.

18 25 An Hour Is How Much A Year Zippia

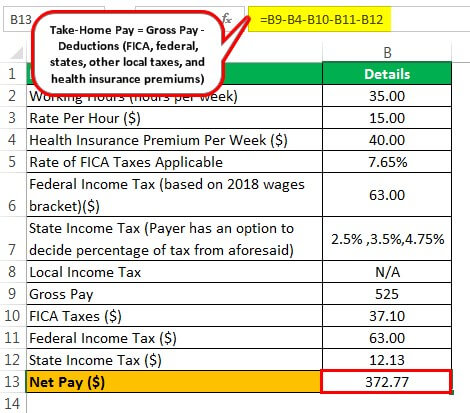

If you work full-time making 10 per hour your weekly gross income will be 400.

. 40 8 x 5 hours per week x 10. So what is 10 an hour annually after tax here is an example. 49k annually is roughly 24 an hour if the employee works 40 hours per week.

However take-home pay will be closer to 41000 annually after taxes. Historically the most common work schedule for employees across the United. 52 weeks x 40 hours per week x 13 per hour 27040 before taxes and deductions.

17 an hour for a 40 hour. By deducting a 25 tax rate from the 13 hourly rate you will find your after-tax hourly. Yet theres more to know if.

In other words if you spend 25 of your salary on rent you probably have enough to meet all your other expenses and still have money to save for a down payment. To calculate how much you make biweekly before taxes you would multiply 19 by 40. For example if you did 10 extra hours each month at time-and-a-half you.

1500 x 12 months 18000. 10 dollars an hour is what per year. Then you would be working 50 weeks of the year and if you work a typical 40 hours a week you have a total of 2000 hours of work each year.

To calculate how much you make biweekly before taxes you would multiply 65 by 40 hours and 2 weeks. If creating each item along with managing supply inventory interacting with customers then shipping the items takes her 2 hour then this comes to 10 per hour. Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 960 after taxes.

Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 1140 after taxes. So if an employee earns 40000 annually working 40 hours a week they make about 1923 an hour 40000 divided by 2080. By deducting a 25 tax rate from the 40 hourly rate you will find your after-tax hourly.

How Much is 40 an Hour After Taxes. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10. Hours Paid Year.

Your yearly salary of 80000 is then equivalent to an average hourly wage of 40 per hour. In this case you can quickly. 10 Dollars an Hour Is How Much a Week.

His income will be. Assuming you work 40 hours a week you would make 536 per week. 40 an hour before taxes is equal to 30 an hour after taxes.

A project manager is getting an hourly rate of 25 while working 8 hours per day and 5 days a week. In this case you can quickly. Next divide this number from the annual salary.

Hours Health Leave Year. How Much is 13 an Hour After Taxes. Hourly wage 2500 Daily wage 20000 Scenario 1.

To calculate how much you make biweekly before taxes you would multiply 16 by 40. 40 an hour before taxes is equal to 30 an hour after taxes. 25 an hour before taxes is equal to 1875 an hour after taxes.

30 an hour at 40 hours per week equals 1200 before taxes and approximately 960 take-home net pay per week. Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 1920 after taxes. How much moneyLets say average rent across the country is 1500 for a one bedroom.

30 an hour at 25 hours per week equals 750 gross. In the state of Massachusetts your income after tax would be. KiwiSaver Employer Contribution Year.

Hours Worked Year. Hours Annual Leave Year. There you got your answer to the question 13 an hour is how much a year.

13 an hour before taxes is equal to 975 an hour after taxes. What is 10 an hour after taxes. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Solved A 2 Deductions Social Gross Federal State Security Medicare Name Earnings Income Tax Income Tax Tax Medicaid Charitable Uniforms Net Earn Course Hero

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Solved It S A Labor Economics Thank You Beforehand 1 When The Fair Labor Standards Act Began To Mandate Paying 50 Percent More For Overtime Work Course Hero

Hourly Wage To Annual Salary Conversion Calculator How Much Do I Make Per Year

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

20 An Hour Is How Much A Year Can I Live On It Money Bliss

3 Ways To Figure Out Your Yearly Salary Wikihow

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes

Solved Imagine That You Are Offered A Job At The End Of Your University Course Hero

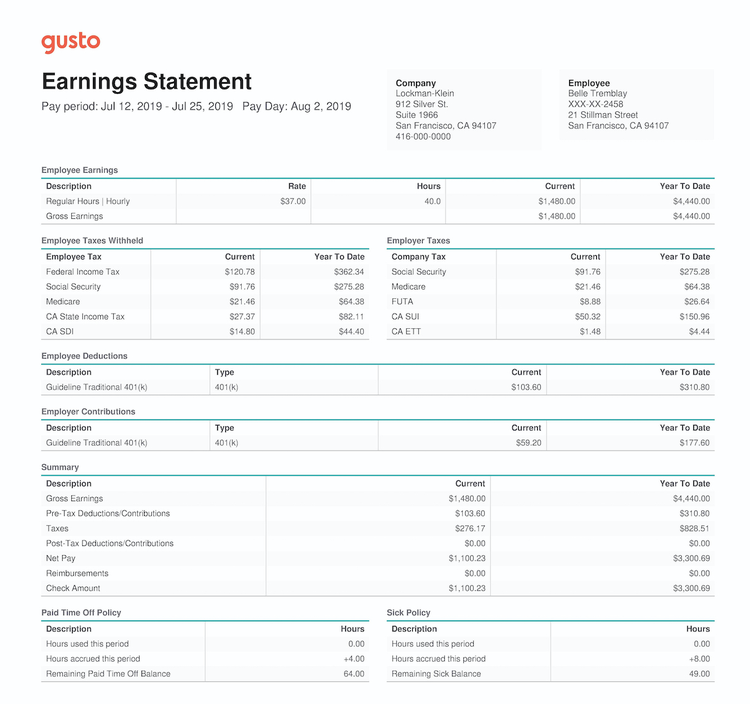

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Biden S Minimum Wage Exaggeration Factcheck Org

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes

Take Home Pay Definition Example How To Calculate

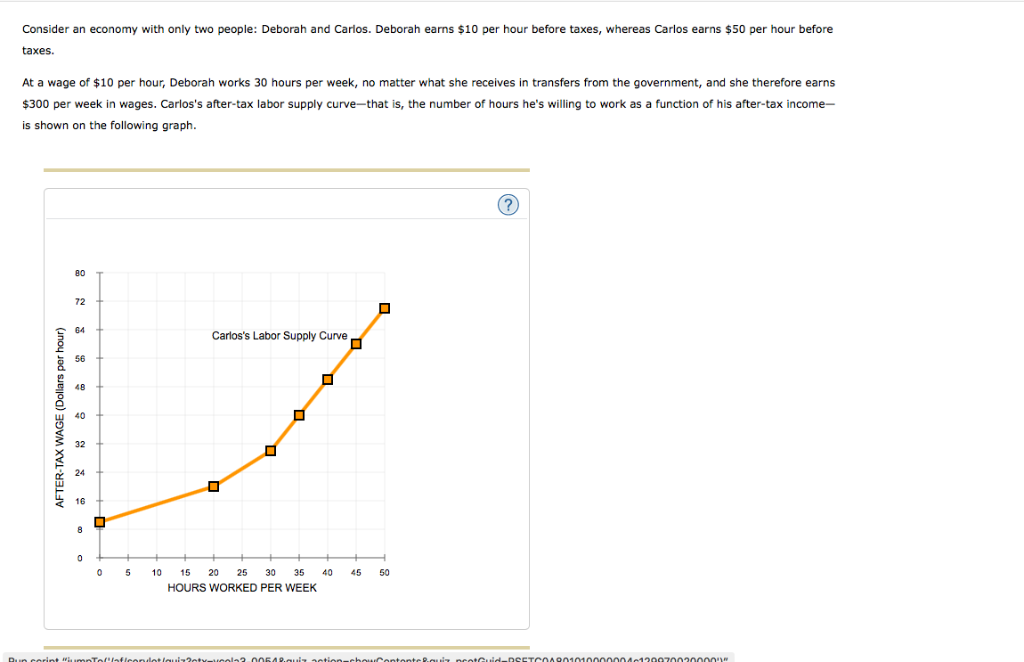

Consider An Economy With Only Two People Deborah And Chegg Com

Take Home Pay Definition Example How To Calculate

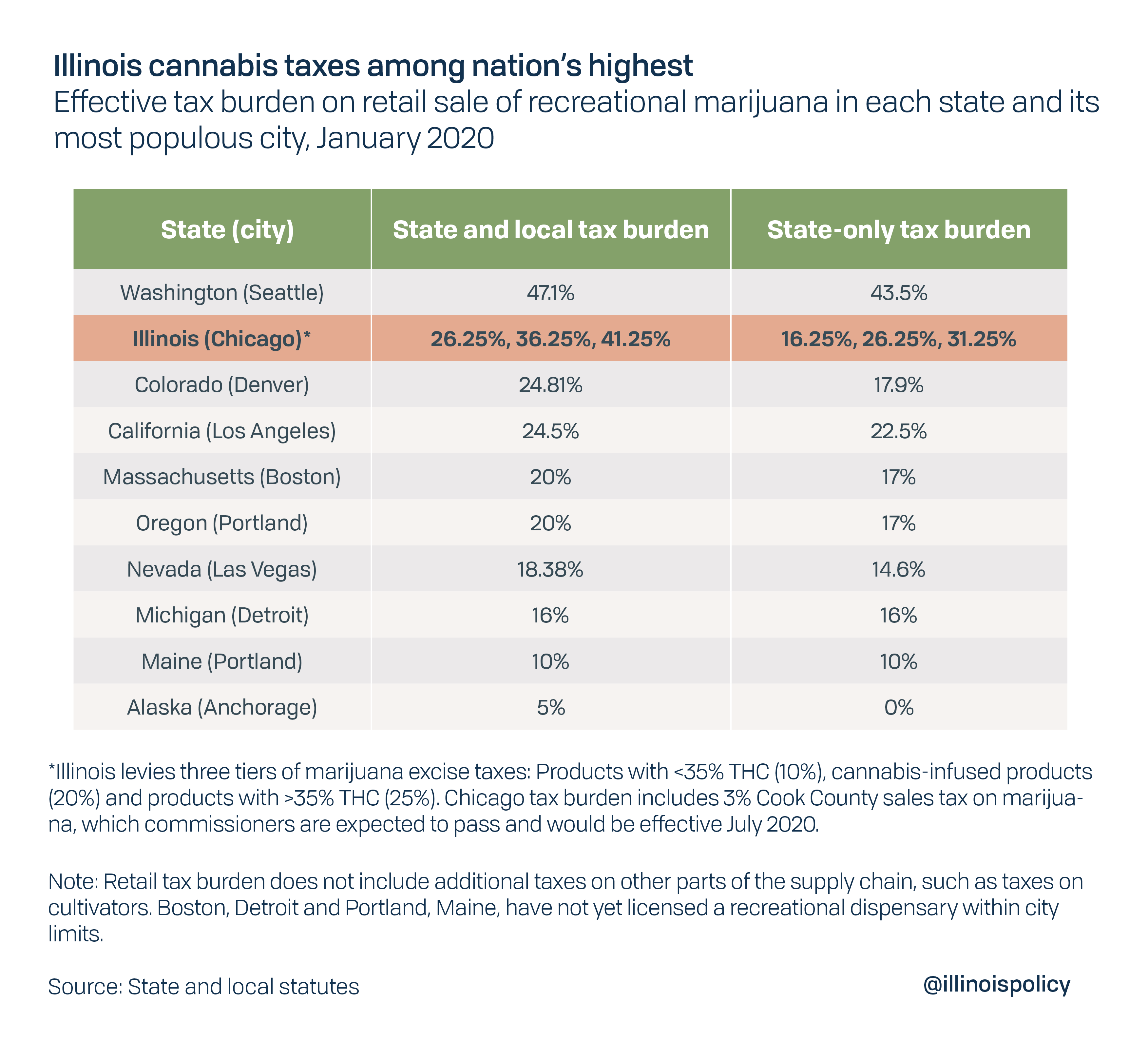

Illinois Cannabis Taxes Among Nation S Highest Could Keep Black Market Thriving

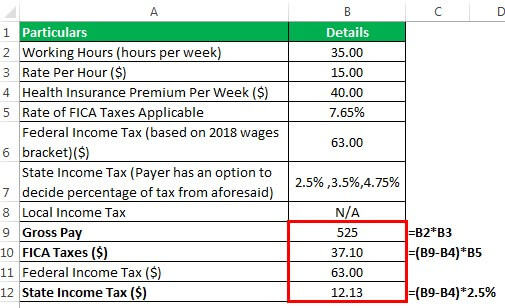

Gross Wages What Is It And How Do You Calculate It

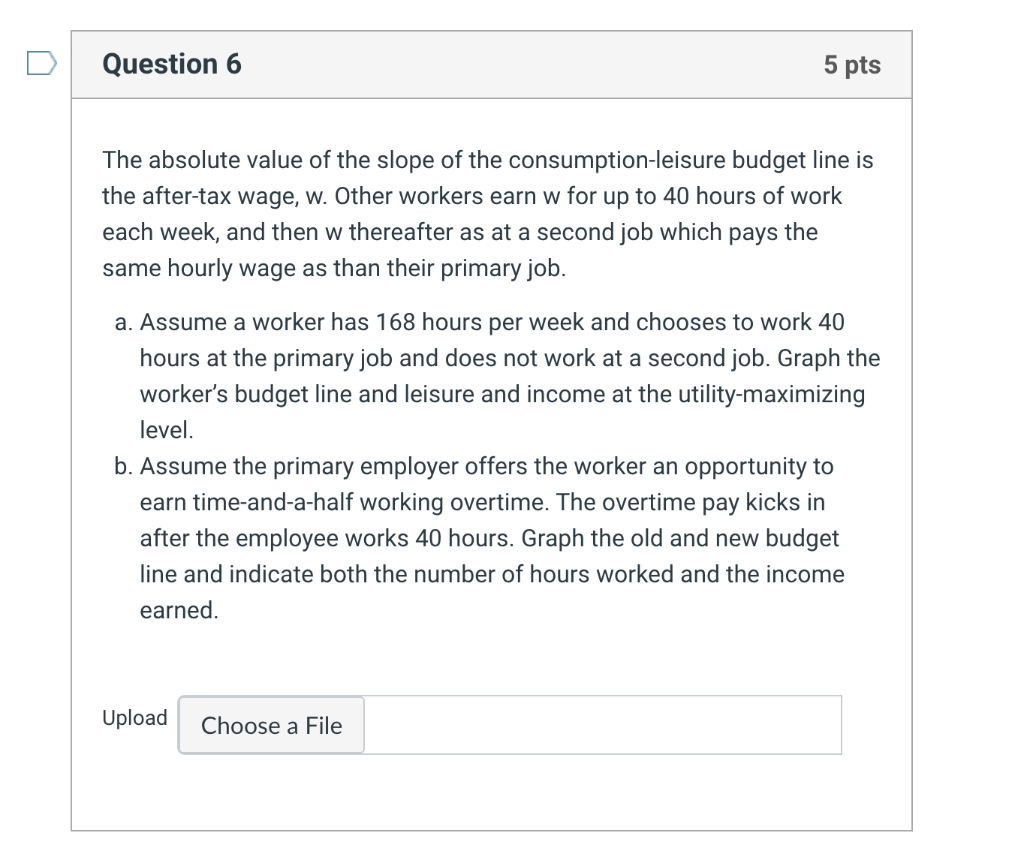

Solved Question 5 5 Pts Shari Can Work Up To 80 Hours Each Chegg Com